Considering a Change? Switch to Your Local Community Bank, Commercial State Bank!

Commercial State Bank and the Independent Community Bankers of America are reminding Americans that their choice of financial institution matters and could impact their ability to secure a loan, obtain favorable fees or rates, or ensure the high-quality, personal service they desire from their bank.

“Community banks have earned the public’s trust because they have proven to be good stewards of their depositors’ money,” said ICBA Chairman Scott Heitkamp. “Because they live and work in their communities, they have a vested interest in pricing their products fairly and practicing prudent underwriting when extending loans. People like knowing that their money is being put to work in their community—making it a better place for all who call it home.”

With so many choices available, ICBA and Commercial State Bank offer the following checklist to illustrate the community bank difference. Community banks offer:

- Local Focus: Community banks channel their loans to the neighborhoods where their depositors live and work, which helps local businesses and communities thrive.

- Relationship Banking: Community bank officers know their customers and consider family history and discretionary spending in making loans.

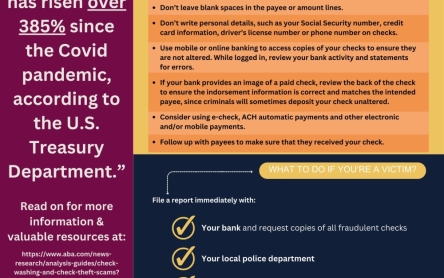

- Innovative Solutions: Community Bankers work hand in hand with customers to ensure they have access to the best innovations possible to meet their needs- including the most secure, reliable and convenient payment options.

- Timely Decision-Making: Community Banks offer nimble decision-making on business loans because decisions are made locally. They are also excellent business advisors because they too are a small business and know the market better than anyone.

- Community Engagement and Accessibility: Community Bankers are deeply involved in their local communities, donating their time, dedication and resources to local causes that make a difference in the lives of residents.

“We pride ourselves on our quality service and strong community ties,” said Krystal Homan, Loan Officer at Commercial State Bank in Nebraska City. “Our customers can count on us to do right by them, because when they succeed everybody wins.”

ICBA and Commercial State Bank also offers these tips to remember before switching banks.

- Make sure all outstanding checks have cleared before closing your old checking account.

- Open an account at your new bank before you leave your old bank.

- Do not close the old bank account until you are sure any direct deposits or automatic bill payments have transferred to the new account.

About Commercial State Bank

Commercial State Bank is an independent, locally owned and managed bank with branches located in Wausa, Nebraska City, and Elkhorn, Nebraska. Commercial State Bank is FDIC insured and regulated by the FDIC and the Nebraska Department of Banking. Commercial State Bank is a member of the Independent Community Bankers Association, the Nebraska Bankers Association, and the American Bankers Association. For more information, visit our website at www.WausaBank.com.

About ICBA

The Independent Community Bankers of America®, the nation’s voice for nearly 5,700 community banks of all sizes and charter types, is dedicated exclusively to representing the interests of the community banking industry and its membership through effective advocacy, best-in-class education and high-quality products and services. For more information, visit ICBA’s website at www.icba.org.